The Lower-of-cost-or-net Realizable Method for Inventory May Be Applied to:

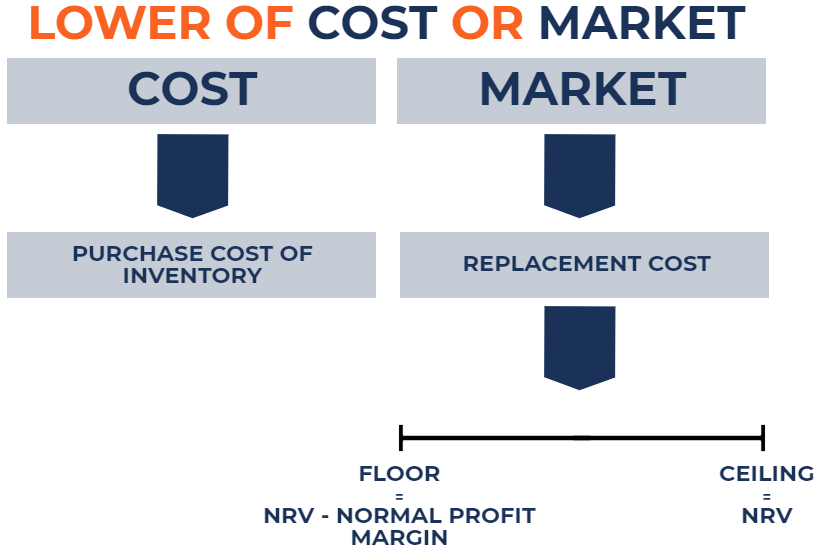

Cost refers to the purchase cost of inventory and market value refers to the replacement cost of inventory. All of the above.

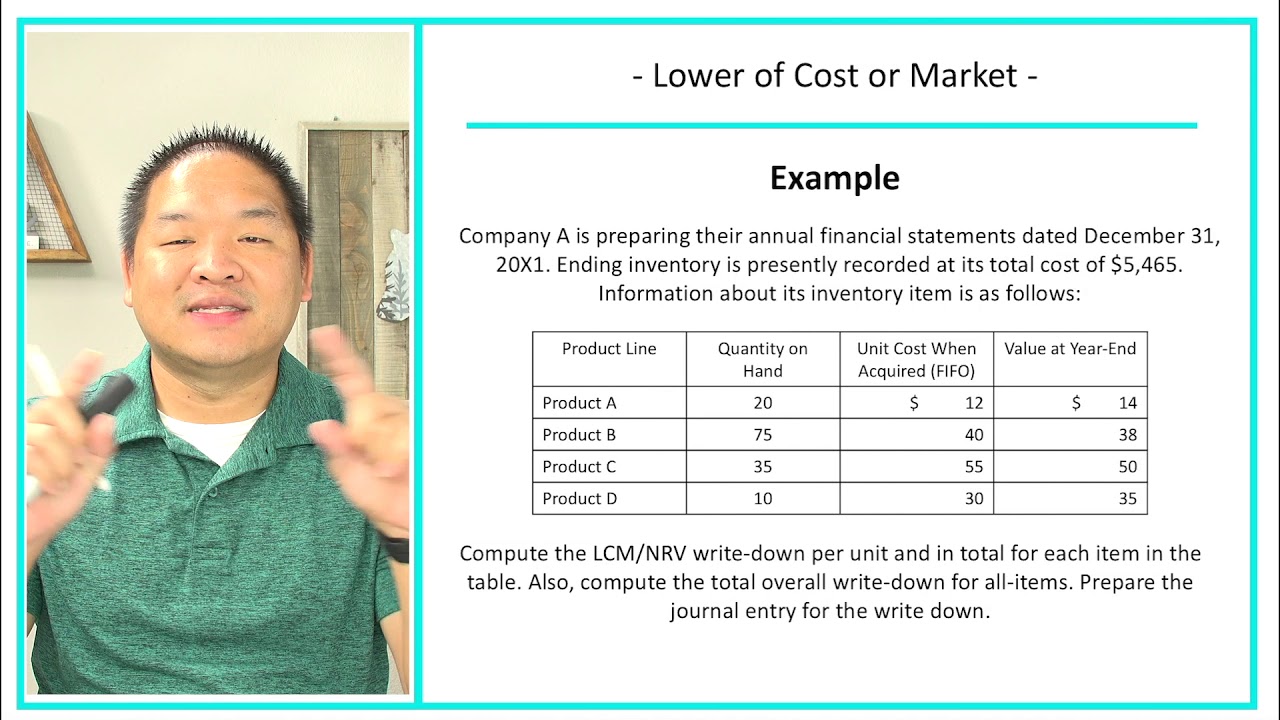

Lower Of Cost Or Market Rule Youtube

This situation typically arises when inventory has deteriorated or has.

. The lower of cost or market calculation can be carried out in five steps as follows. There are no significant costs of disposal. Method of determining cost of goods sold.

Chapter 12 - Lower of Cost and Net Realizable value Measurement of Inventory PAS 2 paragraph 9- provides that inventories shall be measured at the LCNRV Net realizable value-Is the estimated selling price in the ordinary course of business less than estimated cost of completion and the estimated cost of disposal-The cost of inventories may not be recoverable under the following. Net realizable value is the expected selling price of something in the ordinary course of business less the costs of completion selling and transportation. The totals of major inventory classes or categories C.

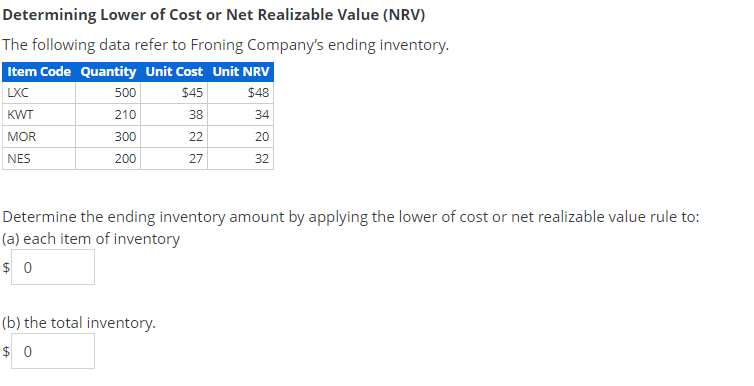

Lower of Cost or Net Realizable Value Applied Learning Outcomes Apply the LCNRV rule to merchandise inventory The LCNRV rule can be applied to each inventory item each inventory class or total inventory and each may have different results. Lower of cost or market old rule The old rule that still applies to entities that use LIFO or a retail method of inventory measurement required entities to measure inventory at the LCM. Any of the above.

Therefore accountants evaluate inventory and employ lower of cost or net realizable value considerations. Expert Answer 100 3 ratings Answer- The lower of cost or net realizable value is an inventory valuation method. Ziegler Company properly applies the lower of cost and net realizable value rule and determines that its inventory value has declined below cost.

The product is currently selling for 220 and has a normal profit margin of 60 and a replacement cost of 75. GAAP allows LCNRV to be applied to individual categories of or the entire inventory. Calculate the Net Realizable Value.

Net realizable value less a normal profit margin. The term market referred to either replacement cost net realizable value commonly called the ceiling or net realizable value NRV less an approximately normal profit margin commonly called the. This simply means that if inventory is carried on the accounting records at greater than its net realizable value NRV a write-down from the recorded cost to the lower NRV would be made.

Which of the following methods may Ziegler use to adjust its inventory to market value. There is a direct reduction in the selling price. Lets refer back to Geyer Co.

Companies may also report an alternative inventory amount in the notes to their financial statements for comparison purposes. NRV and Lower Cost or Market Method Net realizable value is an important metric that is used in the lower cost or market method of accounting reporting. The lower of cost or market rulestates that a business must record the cost of inventory at whichever cost is lower the original cost or its current market price.

In essence the Inventory account would be credited and a Loss for Decline in NRV. The lower of cost or net realizable value is an inventory valuation method that can be applied to. Defer the write-down until the inventory is sold.

Lower of cost or market LCM is an inventory valuation method required for companies that follow US. Inventories are stated at the lower of cost or net realizable value. Reporting of a loss when there is a decrease in the future utility below the original cost.

Net realizable value is the amount that can be realized from the sale of the inventory in the normal course of business after allowing for the costs of realization. How do you find the net realizable value of accounts receivable. The market value which is also known as the replacement cost should follow certain parameters.

The lower of cost or net realizable value concept means that inventory should be reported at the lower of its cost or the amount at which it can be sold. When the cost of goods sold method is used to record inventory at net realizable value 6. There is a controlled market with a quoted price.

Inventory may be recorded at net realizable value if a. Change in inventory value to net realizable value. For financial reporting purposes the lower of cost and net realizable value method can be applied to individual inventory items categories of inventory or the entire inventory.

Lower of cost and net realizable value of inventory valuation is best described as the A. Under the market method reporting approach the companys inventory must be reported on the balance sheet at a lower value than either the historical cost or the market value. The lower-of-cost-or-net realizable method for inventory may be applied to.

It may sound simple that the lower of the cost of the market will have to be recorded. Assumption to determine inventory flow. Net realizable value is defined as the estimated selling price minus estimated costs of completion and disposal.

The lower of cost and net realizable value can be applied to individual inventory items or groups of similar items. Each inventory item B. Reporting inventory at the lower of cost and net realizable value is a departure from a.

Recording of Lower of Cost or Market. The replacement cost cannot exceed the net realizable value or be lower than the net realizable value less a normal profit margin. This concept is known as the lower of cost and net realizable value or.

As an example consider a business which has a product in inventory at a cost of 90 with costs to complete of 30. The lower of cost or market rule states that a business must record the cost of inventory at whichever cost is lower the original cost or its current market price. Common sense dictates that cost has to be lesser than NRV to make profit.

Major class or category of inventory. The lower of cost or market LCM method states that when valuing a companys inventory it is recorded on the balance sheet at either the historical cost or the market value. The lower-of-cost-or-net realizable method for inventory may be applied to.

Total inventory as a whole. Select all that apply a. Generally accepted accounting principles require that inventory be valued at the lesser amount of its laid-down cost and the amount for which it can likely be soldits net realizable value NRV.

Mostly LCM method is applied to individual items but in some cases the entire category of inventory can follow the LCM method. Total of the inventory Answer a. What is the lower of cost or market inventory cost method.

But following a concept of conservatism even if NRV is higher than cost value of inventory is kept at cost and gain is not recognized until the inventory. The total inventory D. Under normal circumstances cost of inventory is always lesser than the net amount business can earn by selling the inventory called net realizable value NRV.

Realizable value the amount to be used for purposes of inventory valuation is a. Cost is determined using standard cost which approximates actual cost on a FIFO basis. The purpose of the adjusting entry is.

Each item in the inventory. Each inventory item B. Which holds auto sound systems speakers and wiring in inventory.

Financial Accounting Lesson 7 14 Lower Of Cost Or Market Net Realizable Value Youtube

Solved Determining Lower Of Cost Or Net Realizable Value Chegg Com

Lower Of Cost Or Market Lcm Definition Inventory Valuation Examples

Comments

Post a Comment